SkyCity Online Casino

- Online Casinos

- Casino Reviews

- SkyCity Online Casino

SkyCity Online Casino Overview

Exclusive 33 No Deposit Free SpinsWelcome Bonus

NZ$100 + 140 free spinsBENEFITS

- 33 No Deposit Free Spins

- Quick registration with your NZTA Driving license

- Wager Free, Free Spins

- 10 Free Spins a day for your first 7 days

Table of Contents

The physical SkyCity casino continually makes its way onto lists of top things to do in Auckland, and now Kiwis can enjoy the same fun from home with the online version.

SkyCity Casino opened its online doors in 2019, through a partnership with the Gaming Innovation Group, and has grown in popularity in the online casino industry ever since. Players instantly fell in love with the elegant theme and the large collection of online casino games powered by the most elite software providers. Not to mention the great welcome offer and ongoing promotions.

This was an easy contender for NZ’s best online casino, and we can safely say it lived up to expectations.

| Overall Rating: 5/5 | |

| Bonus and Offers: | |

| Payment Methods: | |

| Security and Customer Care: | |

| Software and Games: |

SkyCity Online Casino

| 🎰 Casino Brand | SkyCity Online Casino |

| 📅 Year Established: | 2019 |

| 🎁 Bonus Types: | Deposit match, Free spins, No deposit, Live casino |

| 🎮 Game Types: | Pokies, Poker, Roulette, Live games, Progressive jackpots |

| 🎲 Game Providers: | Big Time Gaming, ELK, Evolution Gaming, Microgaming, NetEnt, No Limit City, NYX Gaming, Oryx Gaming, Push Gaming, Pragmatic Play, Play n’ Go, Quickspin, Red Tiger, Yggdrasil |

| 🤑RTP Rate | 97% |

| 💸 Payout Processing Times | 0-24 Hours |

| 🏦 Banking Methods | E-Wallets, Card Payments, Bank Transfers |

| 💱 Currencies: | NZD, GBP, USD, BRL, ARS, EUR, CAD, NOK, CLP, PEN, INR, ZAR |

| 🌏 Languages: | English, German, Spanish, Norwegian, Swedish, Danish, Russian, Turkish, Korean, Finnish, French, Portuguese, Hebrew, Arabic, Chinese, Hindi, Italian, |

| 📞 Support | Live Chat and Email |

| 🪪 Casino Owner | SkyCity Malta Limited |

| 🆔 Gambling License | Malta Gaming Authority, license number: license number is MGA/B2C/880/2021 (issued 01/08/2018) |

In just a few years, SkyCity has already been regarded as one of the best online casinos in New Zealand.

They have certainly changed the landscape for other online gambling websites here in NZ with their quick registration, brilliant game choice, and exceptional customer service. The platform focuses on a classic casino experience centred around integrity, bringing Kiwis exactly what they want: fun games where you can win big and feel valued as a player along the way.

The online version of the popular land-based casino had a fantastic reputation to live up to, so we were keen to put together a review to see if it delivered.

Pros and Cons of SkyCity Online Casino

Throughout all the online casinos we’ve reviewed, there have always been good and not-so-good aspects.

Platforms, particularly in the ever-evolving iGaming industry, should always strive to improve, so we believe that cons are to be expected. For SkyCity, we were pleased to find that there were heaps of positives and very few drawbacks – just how we like it!

Pros

- ✅ SkyCity offers new players a 100% deposit match up to $100 plus an additional 90 bonus spins, 33 of which are no deposit free.

- ✅ Ongoing benefits are in place, with access to 10 free spins a day for the first 7 days.

- ✅ The elegant, sophisticated site design is cool and sleek, making the site a pleasure to play on and ensuring that all games are easy to locate.

- ✅ A good range of payment methods are available, allowing players to pick the one that is the best fit.

- ✅ Great range of games from some of the top names, including slots, table games and a generous Live Casino offering.

- ✅ GIG is a respected, professional brand with a great reputation across the New Zealand casino industry.

- ✅ You can call the team, as well as live chat and email. Phone support is not often available for Kiwis when it comes to online casinos, so this is much appreciated for those of us who like to chat with a human on the phone!

Cons

- ❌ No dedicated mobile app is available, meaning that players will be required to log in through browsers.

SkyCity Online Casino Bonus and Offers

There’s lots to love about joining this one. The bonuses at SkyCity Online Casino are probably the best thought-out bonus package we have come across thus far.

Welcome Bonus

To make it easy for you to see exactly how the welcome offer at SkyCity casino works, we’ve put together a few key pointers below:

- When you deposit for the first time, you can claim a 100% matched bonus up to NZ$100 and 70 Free Spins completely free from Wagering requirements.

- If you sign-up through Best New Zealand Casinos you will get an additional 33 bonus spins without the need to deposit.

- Your spins can be played on popular casino games Dead or Alive 2, TwinSpin Deluxe, Lights, Berryburst and Starburst.

- To trigger the Welcome Bonus package, select it at the cashier before making your first deposit.

This is a great welcome offer for both the casual online casino fan and the VIP players who are looking for high bonus potential. The daily bonus spins allow you to explore the casino without committing any of your own money whilst the deposit match bonus gives players who want to play for higher stakes the opportunity to double their first deposit up to NZ$100.

SkyCity NZ casino free spins are considered “no wagering spins”. These are the best quality bonus spins you can find as there are no wagering requirements attached to anything you win on your spins.

The EXCLUSIVE SkyCity welcome bonus offered on Best New Zealand Casinos offers players 33 no-deposit free spins on registration along with the standard SkyCity welcome bonus of 70 free spins released in 10 free spin increments across your first 7 days after a minimum deposit of $10.

A couple of T&Cs to be aware of:

- The No Deposit 33 Free Spins must be claimed in the Rewards section within three days and spent within seven days of claiming them, so act quickly!

- Also, the Bonus Spins bonus comes with a wagering requirement of 20x the bonus amount. To be eligible to win, you must wager within 30 days of winning.

- The bonus is subject to the Standard Terms and Conditions of SkyCityCasino.com, so be sure to read them carefully before opting in.

VIP Programme

We love to see loyal players being rewarded.

SkyCity Casino NZ offers an excellent Loyalty Program: The Online Club. Made up of 100 Levels, with 5 Tiers to unlock along the way.

We’ve put together some interesting facts about this programme below:

- Climb the Loyalty Tiers: Each level you unlock will grant you a Random Reward that can be a set of bonus spins or real cash. Starting at Level 10, you can unlock Club Tiers, where each tier you unlock will reward you with Random Rewards, as well as an exclusive Tier Reward. You will be eligible for the monthly Online Club promotions, and each Club Tier you earn will allow you access to exclusive offers.

- Early Access to Play Casino Games: From time to time, players who are members of the Online Club may be given Early Access to leaderboard-based promotions and sweepstakes.

- Earn Randomised Rewards on Each Level: SkyCity will credit every Random Reward to your Rewards section, and once claimed, you can exchange your Club Points for bonus spins, Super Spins, or cash prizes.

- Personalised Promotions: Keep your eyes on your email as SkyCity Online Casino will regularly deliver personalised promotions tailor-made to your favourite types of online casino games.

- Personal VIP Support Staff: These are appointed to ensure that your points are continuously updated in real time and that you can contact them whenever you need special assistance.

| Welcome Bonus Details | 100% up to NZ$100 |

| Free Spins Details | 70 Free Spins – Wager Free |

| Wagering Requirements | 35x |

| Minimum Deposit | NZ$10 |

| Other promos | Live casino welcome offer, spin to win, prize drops |

SkyCity Online Casino Payment Methods

There is nothing more satisfying than playing through a selection of thrilling casino games, accumulating big wins, and withdrawing the funds within minutes. It’s one way that an online casino can really make a difference in your experience.

For SkyCity, GIG provides payment processing so you get all the options available at other GIG platform casinos.

Deposits

Players who prefer conventional payment methods such as Credit/Debit Cards can benefit from 3D-secure. This safety measure is a security function that applies when Kiwis use their card online. This gives the transaction an extra layer of security.

At SkyCity Casino, players can transact with New Zealand Dollars. To top up their account, they can use various payment providers such as:

- VISA

- Mastercard

- INPAY

- PaySafeCard

- Skrill

- Neteller

- ecoPayz

Each payment method provides instant deposits, meaning that players can start playing their favourite titles within minutes after registering a new account.

Withdrawals

You can use all the same deposit methods to withdraw your winnings, so this makes things nice and simple.

Most online players wish to know precisely when their money will be back in their bank account. This is why Same Day Payout Casinos are becoming so popular in New Zealand. Even though many NZD casinos will process your withdrawal requests within minutes, it is still important to know which payment provider will determine maximum payouts.

SkyCity Casino can be considered one of the fastest payout casinos in the New Zealand online casino market. The payout times are in line with other top online Fast Withdrawal Casinos NZ, and the NZ$20 minimum withdrawal amount is not unusual.

| Payment Method | Minimum Deposit | Withdrawal Processing Time | Deposit | Withdrawal |

| Visa | NZ$10 | 1-3 Business days | ✅ | ✅ |

| MasterCard | NZ$10 | 1-3 Business days | ✅ | ✅ |

| Bank Transfers | NZ$10 | 1-5 Business days | ✅ | ✅ |

| Apple Pay | NZ$10 | Up to 24 hours | ✅ | ✅ |

| Neteller | NZ$10 | Up to 24 hours | ✅ | ✅ |

| Paysafecard | N/A | N/A | ✅ | ❌ |

| Skrill | NZ$10 | Up to 24 hours | ✅ | ✅ |

| EcoPayz | NZ$10 | Up to 24 hours | ✅ | ✅ |

| Maestro | NZ$10 | Up to 24 hours | ✅ | ✅ |

| Trustly | NZ$10 | Up to 24 hours | ✅ | ✅ |

| iDebit | N/A | N/A | ✅ | ❌ |

| SoFort | NZ$10 | Up to 24 hours | ✅ | ✅ |

| Zimpler | NZ$10 | Up to 24 hours | ✅ | ✅ |

SkyCity Online Casino Security

The SkyCity online casino holds a Malta Gaming Authority Licence which is good news for fans of the SkyCity casino group.

The agreement is between a Maltese subsidiary(SKYCITY Malta Limited) of SkyCity Entertainment and GIG allowing New Zealanders to take advantage of the fact that offshore operators are allowed to offer real money gambling to Kiwis.

When you’re playing online, you want to make sure your financial and personal data is protected. SkyCity does everything it needs to here, including all the usual encryption and firewalls.

So, all-in-all, the security is given a big tick from us.

SkyCity Online Casino Customer Care

When a casino is this popular you can expect they will have a proficient team ready to handle all sorts of challenges. We asked around, and it seems that they really are amazingly capable!

Whether you just have a question about one of their bonuses or have any technical issues around the use of their many functionalities, you can rest assured that their support team will deal with it.

You can get in touch via:

| Support Channel | Availability |

| Live Chat | 24/7 |

| Email Support | help@skycitycasino.com |

| Phone | (0800 654 655) or text to 8006 |

| @SkyCityGroup |

We also advise checking out their FAQ, which answers all the common questions.

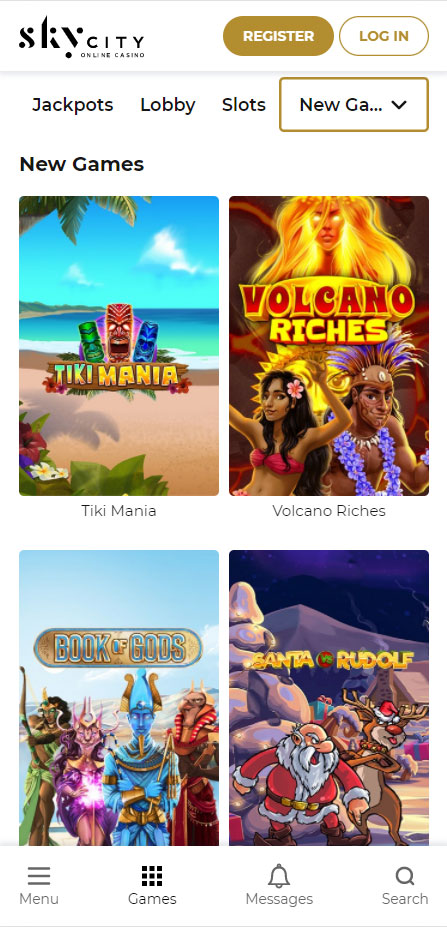

SkyCity Online Casino Games of Software

Kiwis are offered a huge selection of casino games to choose from when they join this online casino.

The variety of games available to GIG casino partners is one of the best in the industry. Sky City has games from all the large game studios like Microgaming, Yggdrasil Gaming and Netent and some smaller studios that provide unique games like Belatra.

🎲 Live Casino Games:

- For all our Kiwis who love to experience the thrill of live casino, SkyCity has various live dealer games such as live dealer roulette, lightning blackjack, and Monopoly Live.

- The friendly dealers will greet you by name and the professionally hosted tables are some of the best on offer in the industry.

🎰 Slot Games

- Enjoy SkyCity games such as well-known online pokies like Immortal Romance, Sugar Rush, Book of Dead, and Starburst.

- You may also want to try something new with more niche slots like ReacToonz.

🃏 Table Games

- Blackjack, roulette, baccarat, and poker – they are all ready for you to play at SkyCity online casino.

- If you’d like a refresher on the rules or learn how to play, the SkyCity blog is a great source of information.

Plus, there is no shortage of progressive jackpot games. The big ones like Mega Moolah and Mega Fortune are there, as well as some smaller less competitive ones like Divine Fortune and Holmes and the Stolen Stones. Tiki Fruits is also available to play offering daily jackpots.

To calculate the most profitable casino games, look at our Return To Player (RTP) percentages.

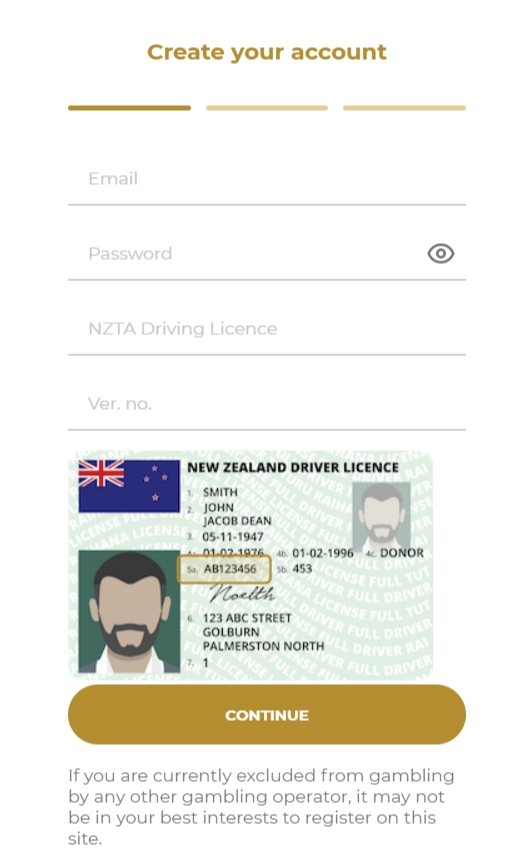

How to sign up at SkyCity Online Casino

As we put together our SkyCity online casino review, we were happy to find it was super easy to sign up and get started.

All you need to do is follow these steps:

- Visit the official website and click on the option to register from the left side of the screen.

- On the first page, you’ll be required to provide your email and create a password. You’ll also need to type in your NZ driving license number.

- Once your account is set, you will then need to log in.

Now, you can fund your Skycity account with whatever amount you like and proceed to play any of the available games.

How to claim the SkyCity No Deposit Bonus

-

About 5 minutes

-

Laptop/Mobile

-

Internet connection

-

18+ In age

Responsible Gambling at SkyCity Online Casino

SkyCity Online Casino is well-regarded not only for its excellent gaming experience but also for its strong commitment to supporting its Kiwi players, and everything we found supported that.

Their dedicated responsible gaming blog is a standout feature, providing valuable insights and practical advice on how to gamble responsibly. This blog covers a variety of topics, including how to set personal limits, take breaks, and customise your gameplay to suit your needs.

You can also find the usual responsible gaming tools like self-exclusion, deposit limits, and session limits.

Plus, don’t forget you can get in touch with their team 24/7 if you ever need a little more help.

| Feature | Description | |

| 🙅Self-Exclusion | ✅ | Allows players to self-exclude from the casino for a specified period to control gambling habits |

| 💵 Personal Limits | ✅ | Set limits on deposits to manage spending and prevent excessive gambling |

| 🕒 Session Limits | ✅ | Set time limits for gaming sessions to promote responsible play |

| 🕹️Responsible Gaming Info | ✅ | Access to information, resources, and tools for responsible gambling awareness |

| 📞 Support and Assistance | ✅ | Contact customer support for assistance with responsible gambling concerns |

Conclusion of SkyCity Online Casino

The team at SkyCity Entertainment Group (who also runs SkyCity Auckland casino) have built an online casino that is brilliantly designed for the New Zealand market.

A fantastic user interface, great payment processing, a welcome bonus that ticks all the boxes, and an authentic gaming experience that understands what we actually need and want when playing online – it’s hard not to class SkyCity as the best online casino in New Zealand.

Would we recommend it? It’s definitely an easy yes for us!

FAQs about SkyCity Online Casino

🎰How easy is it to register at SkyCity Online Casino?

It honestly doesn’t take very long at all. Register via their official website, deposit some cash, and you’re good to go!

🎁How clear are the Bonus T&Cs?

We know that T&Cs can sometimes be super confusing, but SkyCity has set things out fairly clearly so you know exactly what to expect.

🎰How Easy is it to find a game you want?

Games are categorised and can be easily searched by type or provider, so you can quickly find the ones you want to play.

💵How easy is it to deposit and withdraw real money?

There is a wide range of banking solutions available in NZD to facilitate deposits and withdrawals.

🔒How safe is this SkyCity Online Casino?

SkyCity casino is the only NZ casino with a legitimate online offering. SkyCity is a collaboration between the SkyCity Entertainment Group and the Gaming Innovation Group (GIG). They are also licensed in Malta.

📞Is there a live chat, email and phone number?

There’s 24/7 customer support via live chat, email, and phone. The team is highly responsive and ready to help.

📱 Can I play on my mobile?

Although there is no dedicated app, you can still play on your cellphone through your usual browser.

❓How old do I need to be to play at SkyCity Online Casino?

You must be at least 20 years of age to play.

GET THE BEST ONLINE CASINOS IN NEW ZEALAND STRAIGHT TO YOUR INBOX

Subscribe to the FREE Best Online Casinos New Zealand for all the best casinos and special offers